Simon Hughes explains why practice sales transaction times can vary.

This is a question every principal reasonably asks when considering a sale, yet one that is very difficult to answer accurately. Why is it that some transactions can take well over 12 months whilst others sail through in under three?

In the current strong market conditions, the first stage of the sales process can be relatively fast. Clients are often pleasantly surprised when we advise them that they can expect to have ‘heads of terms’ agreed with a buyer within six to 10 weeks. This obviously depends on a number of factors such as practice type, location and whether the asking price is sensible.

The next stage is where things get more complicated, so working with a broker who manages the transaction and works closely with all stakeholders is vital. So, what factors can influence the timing of a dental transaction?

What’s the hold up?

• Specialist solicitors – with an estimated 450-500 dental sales taking place in the current market, there are too few truly specialist advisers relative to demand. We also find that non-specialist solicitors cause unnecessary delays

• Finance – whilst a good number of banks are keen to lend to the sector, the debt raising process is a transaction in itself, which requires an independent valuation and underwriting process involving third-party solicitors for the lender to validate the loan

• Property – assigning a lease or creating a new one is part and parcel of most dental transactions. Landlords need satisfaction that an incoming tenant is creditworthy and references are needed. Often leases can be quite short, which means that new terms need to be negotiated with the landlord

• NHS contract transfer and CQC – most sellers are aware that unless an NHS contract is incorporated it can only be transferred through the ‘partnership route’. This ties in closely with the CQC application and this latter element is often overlooked. Agreeing on a strategy with both buyer and seller in terms of ‘who does what’ is absolutely vital. Where there is an NHS contract in place, a signed copy will always be required – this can often lead to delays

• The stock purchase agreement/ bilateral trade agreement – the sale contract that transfers ownership of assets or shares in a limited company can be relatively easy to negotiate. Matters such as retentions, net asset target calculations, warranties, and indemnities all form part of this. Share sales are increasingly common and can be much quicker

• Associate agreements – where a principal is remaining, his/her terms will need to be agreed. The headline terms are best agreed between buyer and seller and then handed to solicitors for ratification

• Provision of information – poor quality information is the death knell of some dental transactions. In today’s sophisticated market, there is a direct link between the seller providing quality and current information and optimising price

• And finally – the working patterns of the buyer and seller can make an enormous difference to the transaction length. If both are working full time, it can often only be evenings and weekends when attention can be given.

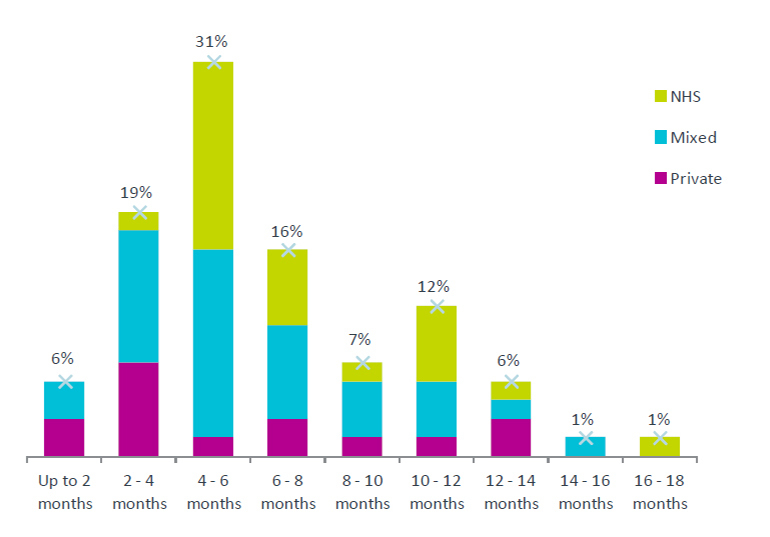

Table 1 illustrates transaction times according to different practice types expressed as a percentage of total transactions over the last 36 months.

Christie & Co is the only broker accredited by the RICS (Royal Institute of Chartered Surveyors). Each year we sell or value many practices across our 15 UK offices for independent owners, corporate bodies and banks.

For more information on Christie & Co, visit www.christie.com, email enquiries@christie.com, or call 020 7227 0700.